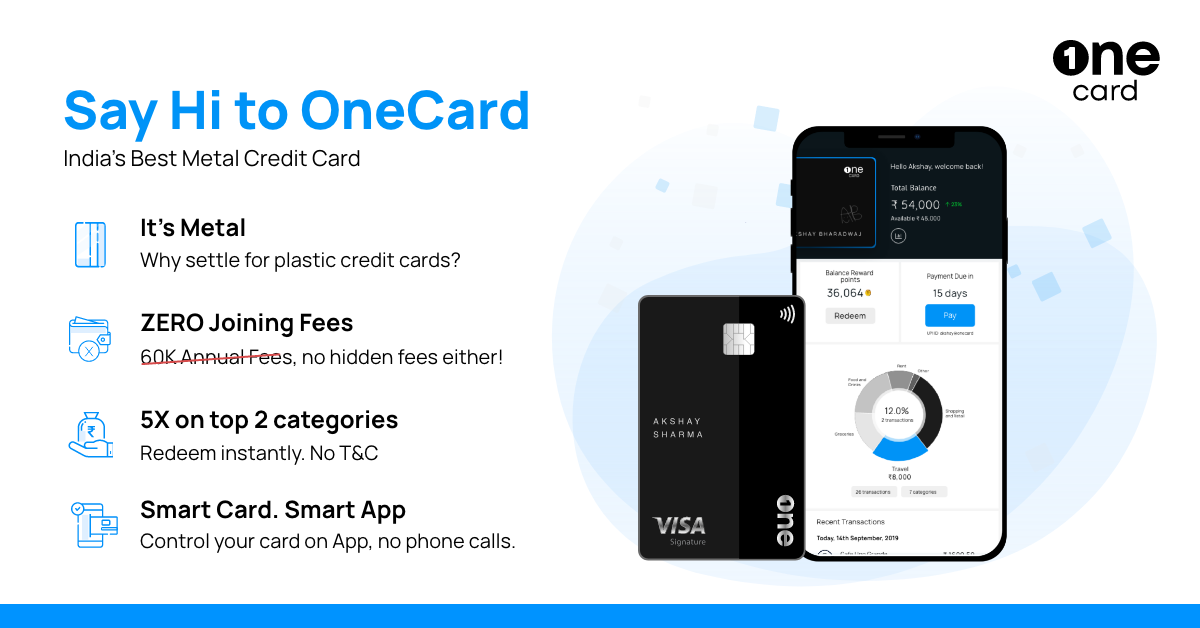

A one-card credit card is a type of credit card that combines multiple cards into a single, streamlined payment system. This means that instead of carrying around several credit cards with different balances and payment due dates, you can consolidate all of your credit card debt onto one card.

One-card credit cards typically offer a number of benefits to consumers. For example, they may come with lower interest rates than traditional credit cards, making it easier to pay off debt over time. Additionally, they often have fewer fees, such as annual fees or balance transfer fees.

Another advantage of a one-card credit card is that it can simplify your finances. Instead of having to keep track of multiple payment due dates and balances, you only need to make one payment each month. This can save you time and hassle, and help you avoid late payments or other issues that can hurt your credit score.

However, it is important to note that not all one-card credit cards are created equal. Some may come with high fees or interest rates, so it is important to carefully read the terms and conditions before applying for a card. You should also consider whether you will be able to pay off your debt before the introductory period ends and the interest rate increases.

Overall, a one-card credit card can be a useful tool for managing your finances and consolidating your debt. However, as with any financial product, it is important to do your research and make an informed decision before applying for a card.

Want to avail this benefit use my promo code - MOHAMM9430.

Eligibility for a one-card credit card will vary depending on the specific card issuer's requirements. Generally, you will need to have a good credit score and a solid credit history to be approved for this type of card. Some issuers may also require that you have a certain income level or a certain amount of credit card debt before they will approve you for a one-card credit card.

Once you are approved for a one-card credit card, you can use it to make purchases just like any other credit card. The main benefit of this type of card is that it allows you to consolidate all of your credit card debt onto a single account. This can make it easier to manage your finances and may save you money on interest and fees.

Some other potential benefits of a one-card credit card may include:

1. Lower interest rates: Because you are consolidating all of your credit card debt onto a single account, you may be able to qualify for a lower interest rate than you would on multiple credit card accounts.

2. Rewards programs: Many one-card credit cards offer rewards programs that allow you to earn points, cash back, or other rewards for making purchases with your card.

3. Simplified bill payment: With a one-card credit card, you only need to make a single payment each month, which can make bill payment easier and more convenient.

Overall, a one-card credit card can be a useful tool for managing your finances and consolidating your credit card debt. However, it is important to carefully consider the terms and fees associated with any credit card before applying, and to make sure that you are using your credit card responsibly to avoid accumulating more debt than you can afford to repay.

You must be logged in to post a comment.