Is it safe to say that you are thinking about making the stupendous stride towards homeownership? Getting a home loan credit is much of the time a crucial part of understanding this fantasy. Nonetheless, the interaction can appear to be overwhelming and complex. Dread not! In this point by point guide, we'll walk you through each step of applying for a home loan credit as of Walk 29, 2024, furnishing you with the most recent data and experiences to enable you on your excursion to homeownership.

Step 1: Assess Your Financial Situation

Prior to jumping into the home loan application process, having an unmistakable comprehension of your monetary standing is urgent. Assess your pay, expenses, and existing obligations. This appraisal will assist you with deciding the amount you can serenely stand to acquire for your home buy.

Step 2: Check Your Credit Score & mortgage types

Your FICO rating assumes a critical part in the home loan endorsement process. Get a duplicate of your credit report from significant acknowledge departments like Equifax, Experian, and TransUnion. Audit your report cautiously for any blunders or inconsistencies that might require tending to. Moreover, do whatever it may take to further develop your FICO assessment if important, as it can affect the terms and financing costs of your home loan credit.

Step 3: Research Lenders and Loan Options

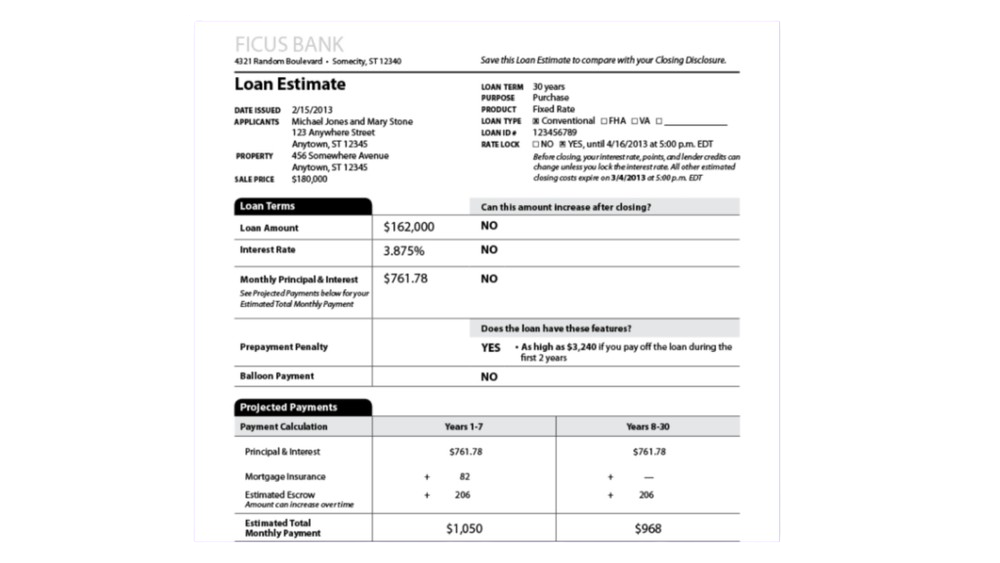

Not all home loan moneylenders and advance items are made equivalent. Get some margin to research and think about contributions from different banks. Consider factors, for example, financing costs, credit terms, expenses, and client audits. This will empower you to pursue an educated choice and select the loan specialist and home loan item that best line up with your requirements and monetary objectives.

Step 4: Get Pre-Approved

Prior to leaving on your home hunting venture, it's wise to get pre-endorsement for a home loan credit. This includes presenting your monetary records to a moneylender who will evaluate your financial soundness and give a pre-endorsement letter demonstrating the credit sum you meet all requirements for. Having a pre-endorsement close by exhibits to merchants that you are a significant and qualified purchaser, possibly reinforcing your bargaining posture.

Step 5: Gather Required Documents

Set up the fundamental records for the home loan application process. These commonly incorporate confirmation of pay, (for example, pay stubs or assessment forms), business history, resource explanations, and recognizable proof reports. Having these archives promptly accessible will smooth out the application interaction and assist with forestalling delays.

Step 6: Complete the Application

Whenever you've chosen a loan specialist and accumulated your records, now is the right time to finish the home loan application. As of Walk 29, 2024, numerous moneylenders offer internet based applications, permitting you to present your data from the solace of your home advantageously. Be careful and exact in giving your monetary data and insights concerning the property you plan to buy. Any disparities or oversights could postpone the endorsement cycle.

Step 7: Undergo the Underwriting Process

After you've presented your application, the loan specialist will start the guaranteeing system. During this stage, they will survey your monetary data, financial record, and the property's examination to evaluate the gamble of loaning to you. As of Walk 29, 2024, guaranteeing timetables might change relying upon the moneylender's responsibility and the intricacy of your monetary circumstance. Be ready to give extra documentation or explanation on a case by case basis.

Step 8: Receive Loan Approval and Clear Conditions

When your application has been looked into, you'll get a credit endorsement choice from the moneylender. On the off chance that there are any circumstances appended to the endorsement, for example, extra documentation or fixes to the property, work with your bank to expeditiously fulfill these necessities. As of Walk 29, 2024, innovation progressions might smooth out the endorsement interaction, considering quicker direction and correspondence among borrowers and loan specialists.

Step 9: Review Final Loan Documents

Prior to shutting, cautiously audit the last advance records given by the bank. Guarantee that all agreements line up with your assumptions and pose inquiries about anything you're uncertain of. Understanding the provisions of your home loan is fundamental for settling on informed choices

Step 10: Review Final Loan Documents and Close the Loan

Before shutting, you'll get last credit reports from the bank framing the agreements of the home loan. Get some margin to survey these archives cautiously and pose inquiries about anything you don't have any idea. As of Walk 29, 2024, progressions in computerized marks and electronic report handling might speed up the end cycle, considering a smoother and more proficient experience. At long last, on shutting day, sign the essential desk work, pay any end expenses and charges, and celebrate as you formally become a mortgage holder!

All in all, applying for a home loan credit can be a perplexing cycle, however by following these nine stages and remaining informed about the most recent improvements in the home loan industry, you can explore the excursion with certainty. As of Walk 29, 2024, mechanical advancements and developing loaning rehearses keep on molding the home loan scene, offering new open doors and efficiencies for borrowers. With cautious preparation, readiness, and the direction of experienced experts, you'll be exceptional to accomplish your fantasy of homeownership.

You must be logged in to post a comment.